Outside of the EU-member countries that export to each other, Ukraine has been the largest exporter of organic products to the EU so far. The war crisis in the country has given birth to lacunae in the supply chain that could be filled by India.

◊ By Bhumika K

Note: To find organic products and organic ingredient suppliers in India, buy the Organic Directory

The European Union is the second largest export market for Indian organic food products but the dynamics of this market and its regulations are changing rapidly.

On March 28, 2022, APEDA (Agricultural and Processed Food Products Export Development Authority) organised a webinar jointly with the Indian Embassies in Brussels and Copenhagen, titled ‘Market Opportunities for Indian Organic Products in Europe’.

The webinar focused on the revised regulations implemented since 1st January 2022 for imports in the EU, and the trending market opportunities for Indian organic products.

In 2020-21, India produced around 34,96,800 metric tonnes of certified organic products, including oil seeds, fibre, sugarcane, cereals and millets, pulses, aromatic and medicinal plants, tea, coffee, fruits, spices, dry fruits, vegetables, processed foods, etc.

U.K. Vats, General Manager, FFV & Organic Division, APEDA, welcomed the over 250 participants of the webinar, including Indian organic exporters, members of Indian embassies in EU member countries, EU and Indian trade body representatives from the organic sector, certification bodies, etc.

Exports of Indian organic products to the EU stood at USD 356 million in 2020-21, accounting for around 34% of the USD 1,040 million worldwide organic food products exported from India, said Vats.

EU ORGANIC MARKET CONTINUES TO GROW RAPIDLY

Santosh Jha, Ambassador of India to Belgium, Luxembourg and the EU, delivering his address, observed that the EU organic agri products market is growing at a very fast pace as demand for organic products outstrips local production levels, giving rise to import opportunities. “As a major producer of agri products in the world, India is adequately placed to supply the EU. The organic retail market has shown double digit growth in the EU for the past many years.” This opens up vast opportunities and huge market potential in the agricultural sector to explore, he told participants.

“Currently only exports of unprocessed organic products are allowed from India to EU. We are working towards a trade agreement with EU on organic products. We have also announced the resumption of India-EU trade negotiations,” Jha said. We have focused our outreach efforts on the recently declared ‘Year of Millets’ to enhance the recognition of Indian millets and millet products around the world and this is part of our efforts to popularise Indian organic agri products in the world, he explained. “We are also working on export of Indian spices and spice blends to EU,” he added.

BUYER-SELLER MEET IN DENMARK IN AUGUST 2022

Pooja Kapur, Ambassador of India to Denmark, emphasised how Danish consumers are the most pro-organic consumers in the world. “Denmark has the world’s highest organic share, and the most well-developed organic market. Organic sales in Denmark continue to set new records every year, with a 14% increase in 2020, the pandemic notwithstanding,” she said.

Danes consider environmentally sustainable organic produce to be an essential component of a healthy lifestyle and of doing their bit for the planet. “Nearly 12.8% of food purchases in Denmark in 2020 were organic, which is the highest organic market share of any country in the world,” said Kapur.

Indian organic products in demand in Denmark include millets, basmati rice, lentils, cassava, gluten-free flour, tea, coffee and spices such as black pepper and turmeric.

Kapur recalled how Prime Minister Narendra Modi mentioned organic millets grown in Uttarakhand being exported to Denmark.

The per capita consumption of organic products by a Dane amounts to 335 Euros (Rs 28,000). Fruits and vegetables make up one-third of organic sales in the retail sector. Bananas, plant-based dairy, carrots, root crops, and cabbage are the most popular products, followed by dairy (making up for one-fifth of organic sales), natural yogurt and milk. In addition, eggs, oatmeal and flour are among the top 10 organically sourced items in the country.

She pointed out that there will be a physical Buyer-Seller Market (BSM) in Denmark in August 2022 as part of the ‘Azadi Ka Amrit Mahotsav’ celebrations, and she invited Indian exporters to participate. There will also be a food festival where Indian organic food products, including millets, will be showcased at the event. APEDA will sponsor Indian organic exporters to participate in BSMs organised in the EU.

Dr. M Angamuthu, Chairman, APEDA, pointed out how last year, of India’s exports of USD 21 billion, the organic sector contributed USD 1 billion. “Last year, India exported over 100 unique products, which are either organic or GI tagged, to over 50 countries. This year, we will promote products from Himachal Pradesh and the Ganges belt, declared by the PM as a Natural Products Sourcing Zone,” he said. While assuring the participating ambassadors that India would provide the best quality and EU-compliant organic products, he also appealed for a “better and wider window” to reach out to the EU.

UKRAINE CRISIS HAS OPENED UP EXPORT OPPORTUNITIES FOR INDIA

Michel Reynaud, Board Member of IFOAM Organics Europe & Vice President, ECOCERT, delved into the details of the new import regimes and trade agreements being implemented in the organic import sector in the EU. He stressed on the big changes in certification bodies, compliance, and free trade agreements (FTA) regarding imports from Third Countries. “The EU will be moving from equivalence to compliance,” he stressed. The previous equivalence agreement (Annex III of Reg. 1235/2008) expired on December 31st, 2021. Third Countries like India can discuss and negotiate Trade Agreements with EU until December 31st, 2026.

Exporters from Third Countries will have to obtain certification according to the new European regulation by 31st December 2024 at the latest to continue exporting products to Europe. Beyond this date, equivalent CB (Control Body) standards will no longer be recognised, he reiterated. The list of control bodies recognised for the purpose of compliance (per product category, per country) will soon be created, said Reynaud in his presentation, ‘The Import Regime for Organic Products in the EU and Main Import Data’.

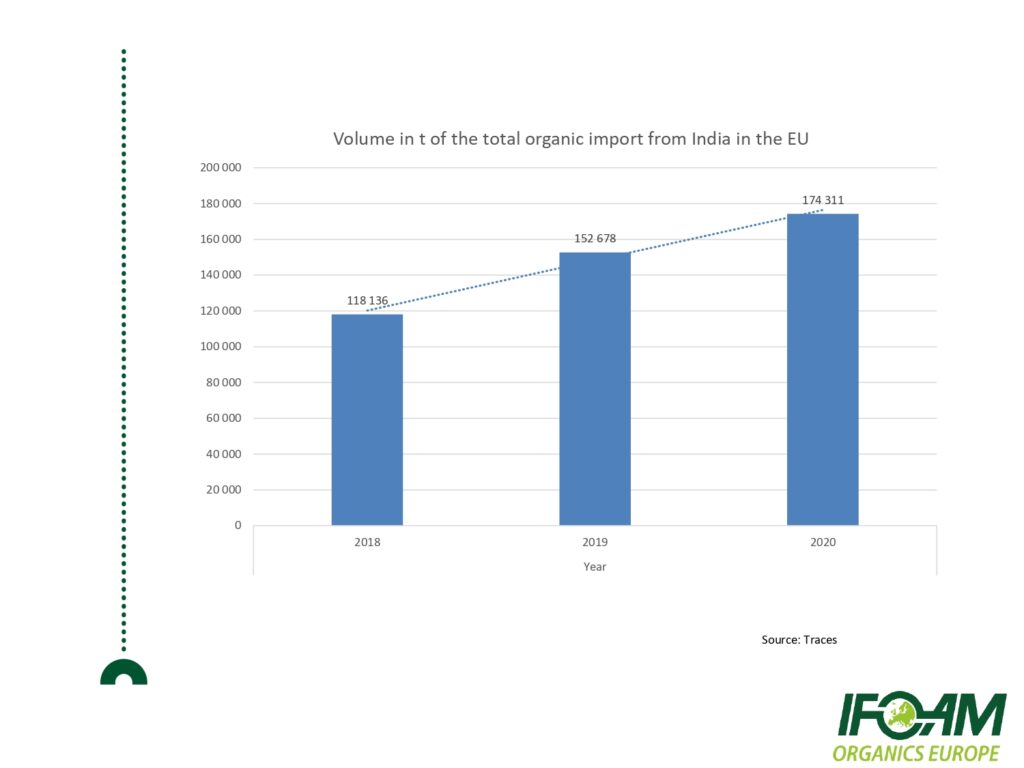

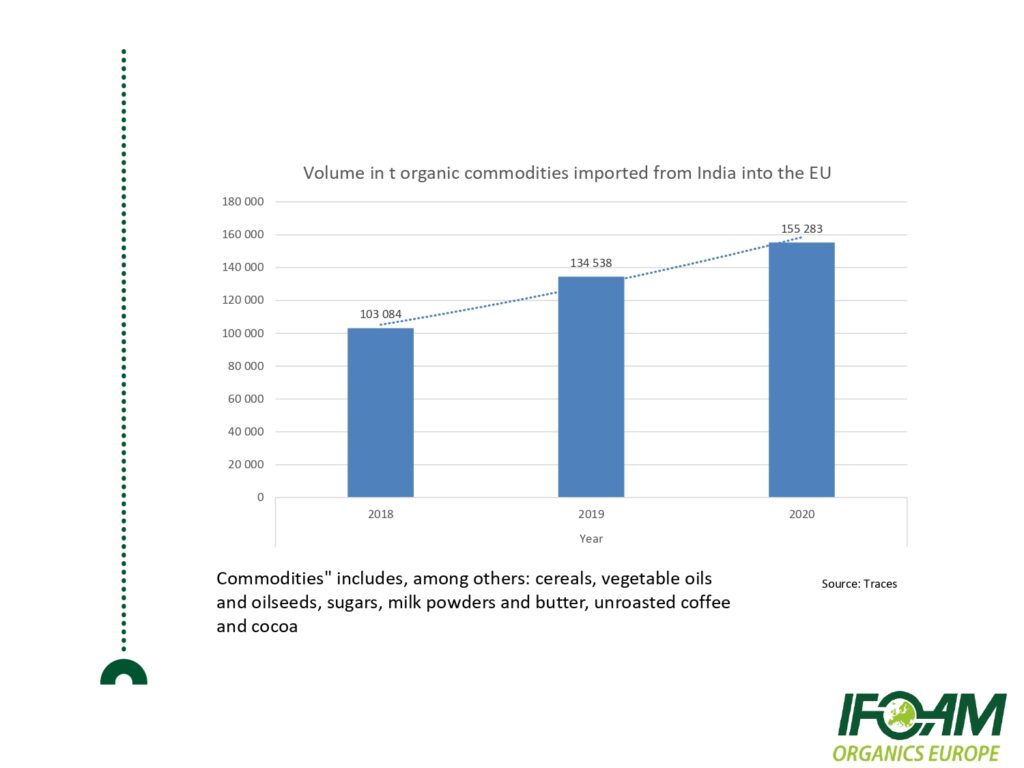

In the last three years, import volumes of total Indian organic products exported to the EU has grown from 118,136 tonnes in 2018 to 152,678 in 2019, and 174,311 in 2020. The volume of exported organic commodities to the EU, including, cereals, vegetable oils and oilseeds, sugars, milk powders and butter, unroasted coffee and cocoa, went up from 103,084 tonnes in 2018 to 134,538 in 2019 and to 155,283 tonnes in 2020.

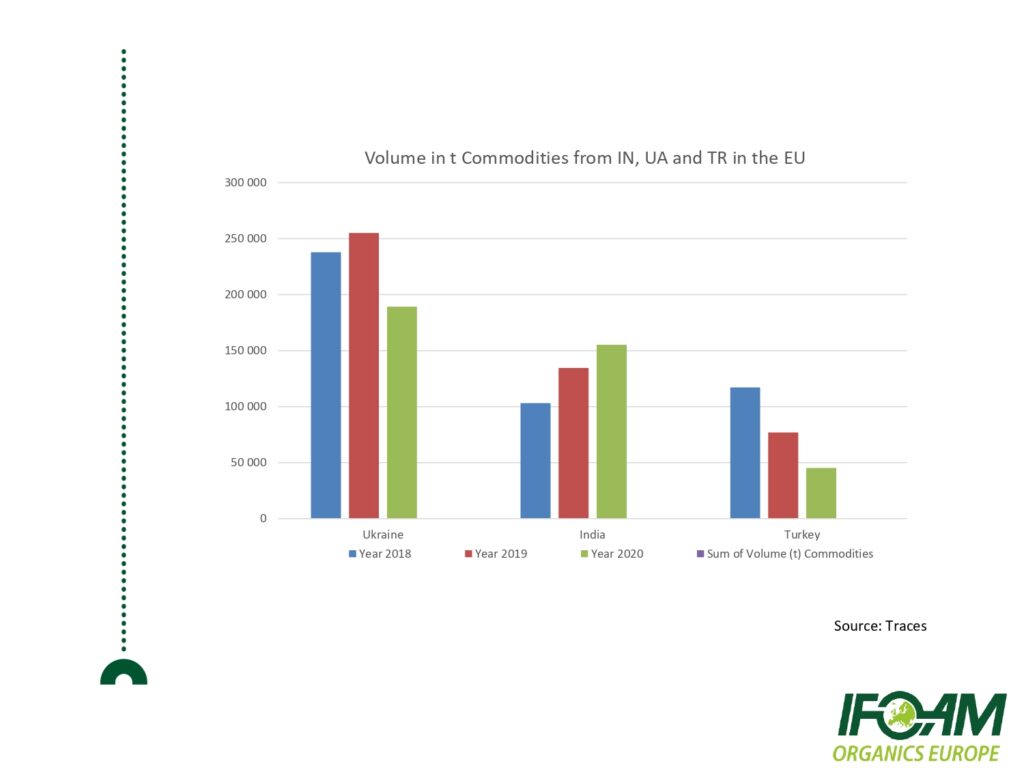

Outside of EU-member countries that export to each other, Ukraine has been the largest exporter of organic products to the EU (approximately 250,000 tonnes of organic commodities exported in 2019 to the EU by Ukraine), and since the war crisis in Ukraine has disrupted the supply chain to the EU, an opportunity has opened up for India. (For example, oilcake prices are rising due to the Ukraine crisis). Turkey also is a prolific exporter of organic products to EU countries but it is second to India.

Aurora Abad, Association Manager, OPTA (Organic Processing and Trade Association Europe), which represents the interest of EU organic processing and trade companies, in her presentation, detailed how in 2020, the EU-27 imported 2.79 million tonnes of organic products. Main imports include tropical fruits, nuts and spices, oilcakes, beet and cane sugar, vegetables, unroasted coffee and tea.

Nearly 120 countries currently export to the EU. The upcoming revamp of EU trading arrangements in organics is being implemented in order to increase control mechanisms and checks to prevent fraud and diversion from EU standards, and to gain reciprocal access to markets, Abad said. “India will have to open up to our exports too,” she added.

CHALLENGES AHEAD FOR INDIAN ORGANIC PRODUCT EXPORTERS

In order to address the challenges faced by Indian exporters in exporting organic products to the EU, a panel discussion was also held with members of Organic Denmark, Confederation of Organic Industry of India, IFOAM and OPTA representatives.

Pankaj Agarwal, Founder, Just Organik and President, Confederation of Organic Industry of India, listed some of the key concerns of Indian exporters to the EU – exporting fresh produce to the EU is a challenge and exporters need handholding and inputs from buyers on what are the produce needed, as well as, expected shelf life. He elaborated on the challenges of high costs of testing in European laboratories. He also pointed out there is an agri barrier which makes it tough to place Indian products on European shelves. “We are looking for integrated development of product and process,” said Agarwal. He also noted how India continues to be an ingredient supplier. “We get only a differential premium of 15 to 30%. We would like to work on product development and cost optimisation,” he shared.

TRADE AGREEMENTS (Courtesy of Michel Reynaud)

– Previous equivalence agreements (Annex III of Reg.1235/2008) expired on December 31st, 2021.

– Annex 1 of R (EU) 2021/2325 is now applicable until December 31st, 2026 at the latest (Article 48 of Reg. 2018/848).

– European Directive 2021/1345 authorises the opening of negotiations for Trade agreements with third countries.

– Third countries can discuss and negotiate Trade Agreements with EU until December 31st, 2026.

– USA/EU Trade Agreement has to be implemented in the coming years, as well as, other ones.

– UK, Chile and Switzerland have already signed Trade Agreements with EU.

– For exporting products to EU, COI (Certificate of Inspection) on TRACES system remains.

FROM EQUIVALENCE TO COMPLIANCE (Courtesy of Michel Reynaud)

– List of control bodies recognised for the purpose of the compliance (per product category, per country) to be created.

– Previous equivalent CBs listed in Annex IV of Reg. (EC)1235/2008 expired on December 31st, 2021.

– Annex 1I of R (EU) 2021/2325 is now applicable until December 31st, 2024 at the latest (Article 48 of Reg.(EU) 2018/848).

– This means, in practice, that operators in third countries will have to obtain certification according to the new European regulation by 31 December 2024 at the latest to continue exporting products to Europe. Beyond this date, equivalent CB standards will no longer be recognised.

– The commission may grant specific authorisations, renewable for 2 years, for the use of products and substances (inputs) in third countries.

– For exporting products to EU, COI on TRACES system remains.

Leave a Reply